Economy

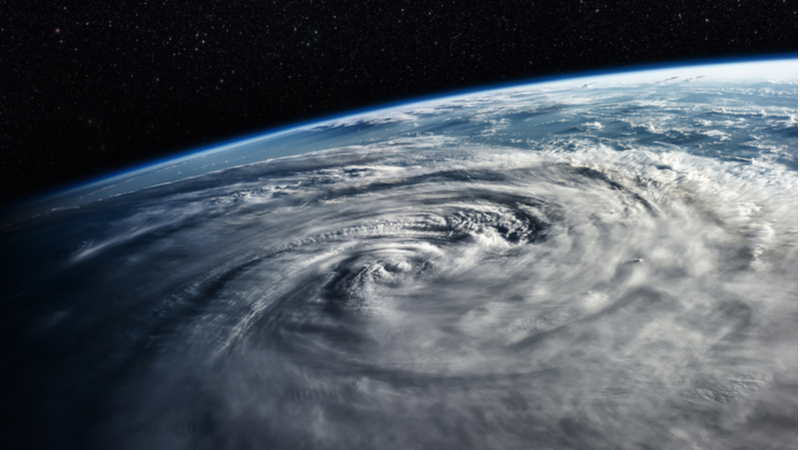

How Much Did Cyclone Shaheen Cost Insurance Companies In Oman?

The weekly reports monitored by the Capital Market Authority (CMA) to follow up on the insurance companies on settling the claims and paying the compensations after the cyclone ‘Shaheen’ revealed that the volume of the claims stood at about RO62.373mn so far.

This comes through the registration of more than 9,800 claims distributed over a number of the Wilayats affected by the cyclone in the governorates of Muscat, North and South Al Batinah.

The data indicated that most of the claims submitted to insurance companies were accepted for all those affected by the cyclone ‘Shaheen’ who hold insurance policies that cover the risks of natural disasters, whether to insure vehicles, property, transportation and other insurance coverages.

The data also indicated that about RO51.7mn are still under settlement as reparation for these damages requires some time because they are houses, buildings, and other facilities.

Insurance companies paid about RO10.6mn to redress other damages, and the indicators of the size of the compensation are expected to rise and reach approximately RO69mn by the end of the settlement of all claims related to the cyclone ‘Shaheen’.

As for the size of compensation for each insurance product, the data indicated that property insurance acquired the largest share, as its total compensation exceeded RO45.3mn, which represents insurance of homes, buildings, facilities, and other properties, followed by motor insurance with a total amount of RO8.9mn.

Then comes the engineering insurance with a share of about RO7.5mn, which is the insurance that is concerned with securing industrial sites, facilities, devices, and equipment. The rest is distributed to other types of insurance.

On the other hand, the data of the geographical distribution of insurance claims as a result of the cyclone ‘Shaheen’ showed the direct effects in a number of Wilayats of the governorates of North and South Al Batinah, as well as in the rest of the Wilayats of the Sultanate in a cumulative way to determine the affected spatial dimension and its concentration in the Wilayats and governorates.

The largest number of claims of all kinds was reported in the Governorate of Muscat, with 4,391 claims, followed by the Governorate of North Al Batinah, especially the Wilayat of A’Suwaiq, with a total of 2,632 claims, and the Wilayat of Al Khabourah, with 1,023 claims, while the rest of the claims were distributed among Wilayats such as Sohar, Saham, A’Rustaq, Al Musanah, and Barka.

The total volume of claims paid by insurance companies from the beginning of 2021 until 16 December 2021 amounted to about RO173.514 million. These figures reflect the role played by the insurance sector in managing risks at the level of individuals and institutions as one of the available means to enhance the principle of protection and social and economic security.

-

Real Estate2 months ago

Real Estate2 months agoAl Mouj Muscat Unveils Azura Beach Residences Phase 2: A New Chapter in Waterfront Living

-

Leaders Speak1 month ago

Leaders Speak1 month agoDhofar International Development and Investment Company: Driving Sustainable Growth and Strategic Synergies in Oman’s Investment Landscape

-

Events1 month ago

Events1 month agoOER Corporate Excellence Awards 2025 Honours Entities and Innovations in Oman

-

Economy1 month ago

Economy1 month agoMaal Card: What Oman’s New National Payment Card Means for Everyday Users

-

OER Magazines2 months ago

OER Magazines2 months agoOER, October 25

-

Arts and Culture2 months ago

Arts and Culture2 months agoOminvest and Bait Al Zubair Launch “Future Frames” to Empower Youth through Art and AI

-

Entertainment2 months ago

Entertainment2 months agoWhere Heritage Meets Haute Couture: Al Sadaa Haute Couture Transforms the Sultanate’s Fashion Scene

-

News2 months ago

News2 months agoMs. Noor Saldin, Founder of Modern Generation International School, Wins Woman of the Year 2025; School Honored for Empowering Future Female Leaders