Banking & Finance

Alizz Islamic Bank And Oman Housing Bank Signed An Agreement For The “Iskan” Program.

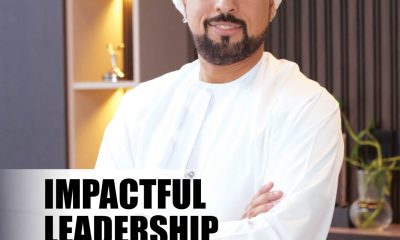

Muscat: The CEO of Alizz Islamic Bank, Ali bin Saif Al-Mani affirmed that the partnership with Oman Housing Bank, the “Iskan” program aims to enhance the bank’s role in supporting urban development projects undertaken by the government. This collaboration involves providing supported housing financing to eligible citizens.

The program aims to facilitate housing financing for citizens on the waiting lists of Oman Housing Bank and the Ministry of Housing and Urban Planning, supported by various local banks operating in the Sultanate. The agreement was signed by Mr. Ali bin Saif Al Mani, CEO of Alizz Islamic Bank and Mr. Moosa bin Masoud Al-Jadidi, CEO of Oman Housing Bank.

Alizz Islamic Bank actively seeks to contribute to all development initiatives benefiting the Country and its citizens, whether through partnerships with Oman Housing Bank or by offering services and products aligned with Islamic Sharia principles. Mr. Ali Al Mani, CEO of Alizz Islamic Bank emphasized that through this partnership, they aim to support many Omani families who meet the eligibility criteria for receiving housing financing. This humanitarian principle will contribute to extending the veins of urban development to various provinces of the Sultanate and enable many Omani families to afford homes. This reflects the belief that the prosperity of individuals leads to the prosperity of societies. Therefore, a dedicated team has been formed to process financing requests referred to Alizz Islamic Bank, streamlining transaction processes.

Through the electronic platform Iskan (iskan.ohb.co.om), eligible citizens can access the platform’s page, complete registration procedures with easy steps, and choose Alizz Islamic Bank for housing financing. The financing is in line with Islamic Sharia principles, featuring straightforward and flexible transaction procedures. All products and services provided by the bank have been approved by the bank’s Fatwa and Sharia Supervision Authority.

After submitting the application to Alizz Islamic Bank and completing all procedures, the bank will review the request and send a financing offer, including the financing amount, expected monthly installment, service fee percentage, expected financing duration, and any other applicable fees. The purpose of obtaining financing includes building a home, purchasing a ready-made home, purchasing an unfinished home and completing it, or purchasing residential land and building a home on it. The financing amount can reach up to OMR 60,000 and OMR 80,000 for citizens interested in buying housing units in complexes developed by the Ministry of Housing and Urban Planning.

On the other hand, Alizz Islamic Bank employs the latest digital technologies to ensure transactions are completed with utmost ease. Therefore, Alizz Islamic Bank is the optimal choice for those seeking housing financing, especially as the bank continuously strives to secure the lives of citizens by helping them own their dream homes and Alizz Islamic bank is considered a strategic partner in the “Iskan” program.

-

Banking & Finance1 week ago

Banking & Finance1 week agoOman Arab Bank Announces Increase of Authorised Capital to RO500mn and Paid‑In Capital Boost of RO50mn

-

Renewables1 month ago

Renewables1 month agoJindal Renewables and OQ Alternative Energy Sign Joint Development Agreement to Advance Integrated Renewable Power Projects in Oman

-

Bahrain6 days ago

Bahrain6 days agoSPIEF 2025 focused on global and regional economic processes, market transformation, new tech, investment climate, financial policy and people

-

Alamaliktistaad Magazines1 month ago

Alamaliktistaad Magazines1 month agoAl-Iktisaad, May 25

-

Leaders Speak2 months ago

Leaders Speak2 months agoOERLive SPOTLIGHT: Oman Sustainability Week 2025 and Oman Petroleum & Energy Show

-

Business2 months ago

Business2 months agoSt. Petersburg International Economic Forum 2025 unveils its Business Programme

-

OER Magazines1 month ago

OER Magazines1 month agoOER, May 2025

-

Banking & Finance2 months ago

Banking & Finance2 months agoAlizz Islamic Bank Partners with Al Tawasul Institute for Specialised Training Programme to Empower Job Seekers with Hearing Impairments