PR

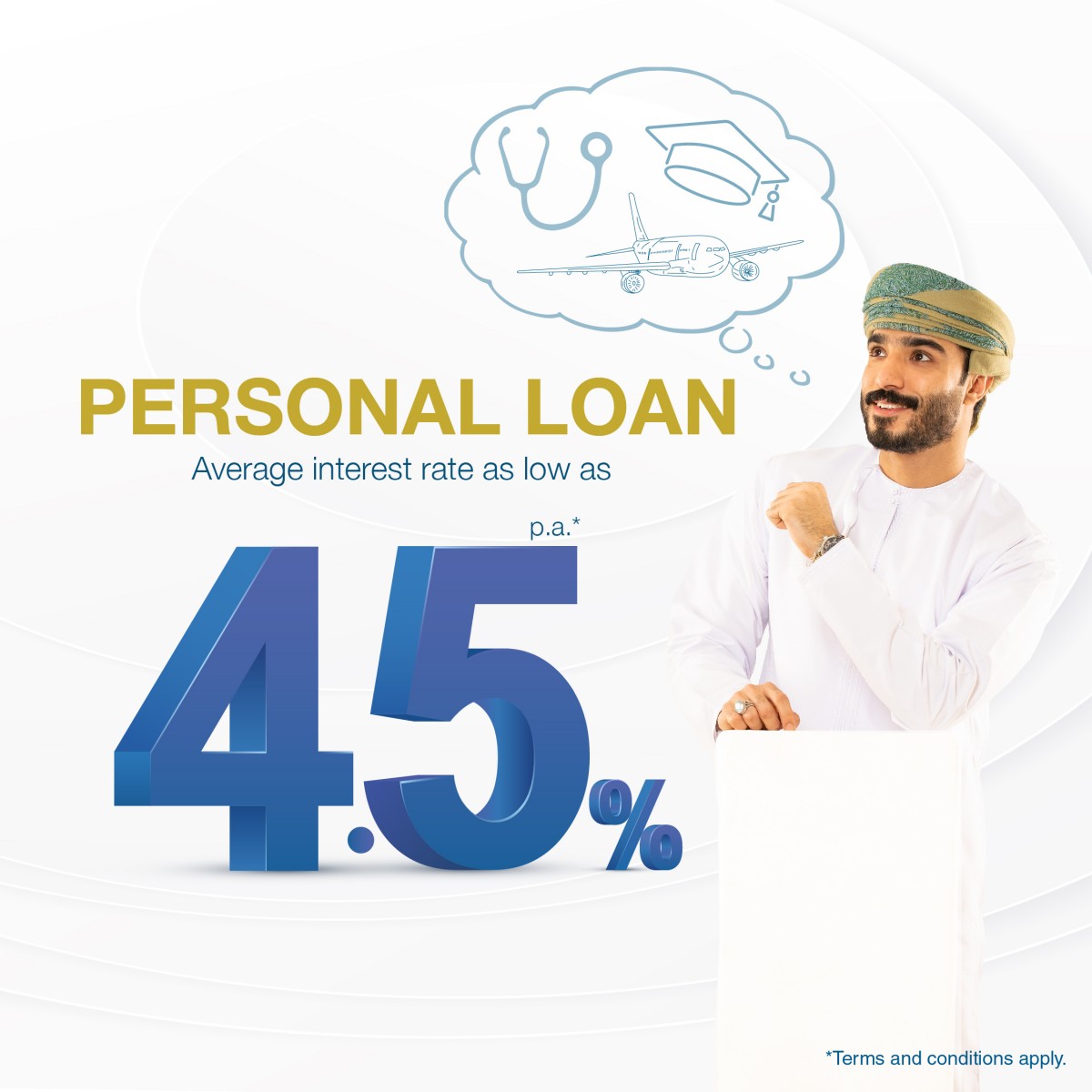

Ahlibank Offers Personal Loans With Interest Rates Starting From 4.5%

In a bid to enhance financial freedom and establish accessible avenues to fulfill personal obligations and aspirations, ahlibank is offering a bouquet of loans through its popular MyLoan facility, at interest rates starting from 4.5%.

The personal loan program is structured to facilitate customers with right credit options that entail competitive pricing and flexible repayment terms with hassle free experience. It is aligned with best industry practices to ensure quicker turnaround time for loan approvals, offering customers the choice to opt for tenures and plans that are suitable for their salaries/incomes.

The loan program is open to customers from all walks of life, with the Bank setting slabs for government and private sector employees, as well as for expatriates. The maximum loan amount is accordingly fixed, with OMR 200,000 for Omani employees in the government and quasi government sectors, and OMR 150,000 for Omanis employed in the private sector. Expatriates can avail a maximum of OMR 50,000 as personal loans.

While the maximum age of maturity or retirement is 60 years for Omanis and 55 years for expatriates, the maximum loan tenor is up to 10 years for Omanis and up to 5 years for expatriates. All customers need to complete a mandatory requirement of six months of service and should be aged not less than 21 years.

“ahlibank’s MyLoan is the key to unlock doors to our customers’ dreams and aspirations; we want to instill in them a sense of financial freedom to be able to meet the priorities in their lives. We have, since the beginning, endorsed the idea of financial inclusion and have created exciting avenues and promotions to build customer confidence. This has borne results; today, we see customers approaching us through our branches to seek financial solutions for their everyday requirements, as well as for major purchase decisions,” explained Muneer Al Balushi, AGM – Head of retail distribution at ahlibank.

Adding further, he said, “The very idea behind MyLoans is to motivate customers to start realizing their dreams. Our prime objective is to apprise borrowers that there are no additional burdens and that the repayment option is relatively smooth and convenient.”

ahlibank’s personal loan program is suitable for customers of different banking segments, as it is in sync with the Bank’s customer-centric operations.

-

News2 months ago

News2 months agoAI Security Conference 2025 Hosted by Securado Highlights the Changing Cybersecurity Landscape

-

Insurance2 months ago

Insurance2 months agoSupporting Community Wellness: Liva Insurance Sponsors Muscat Marathon 2026 with Free Health Checkups

-

Interviews1 month ago

Interviews1 month agoEXCLUSIVE INTERVIEW: TLS Rebranding Marks Strategic Leap Toward Innovation, Sustainability & Growth

-

Insurance1 month ago

Insurance1 month agoLiva Insurance Supports Community Wellness Through “Experience Oman – Muscat Marathon 2026”

-

Investment3 weeks ago

Investment3 weeks agoLalan Inaugurates Its First Overseas Manufacturing Facility, Marking Sri Lanka’s First Investment in SOHAR Freezone

-

Banking & Finance1 month ago

Banking & Finance1 month agoA New Platform for SME Growth: Oman Arab Bank Unveils Tumouhi

-

Construction3 weeks ago

Construction3 weeks agoInternational Heavy Equipment hosts Open Day at its Refurbished Facility in Sohar Industrial Area

-

News3 weeks ago

News3 weeks agoKunooz Oman Holding Partners with Belgian company Etex for Local Gypsum-Based Business Development