Sports

Michael Jordan Makes Foray Into Esports With Startup Investment

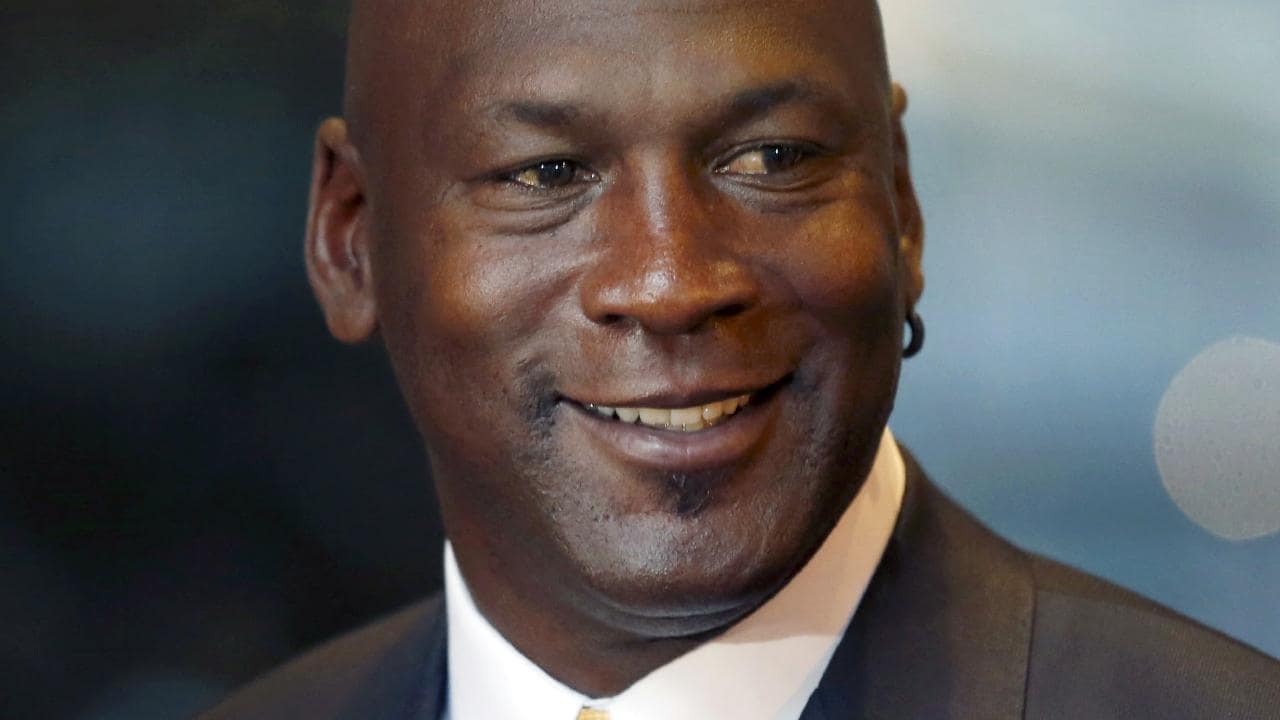

Michael Jordan is backing an esports startup, the first foray by the legend of traditional sports into the burgeoning industry.

The basketball Hall of Famer and owner of the NBA’s Charlotte Hornets is joining an investor group putting $26 million into AXiomatic Gaming, which owns the professional-gaming franchise Team Liquid. The round is being led by Jordan, investing thorough his family office, and Declaration Capital, the family office of Carlyle Group billionaire co-founder David Rubenstein.

AXiomatic was formed in 2015 to capitalize on the esports industry, which features professional video-game players competing for prize money in front of often-huge audiences. The following year it acquired a controlling stake in Team Liquid — a business now worth about $200 million, according to recent valuations by Forbes. That would make it the third-most-valuable esports franchise in the world.

AXiomatic, which was part of Walt Disney Co.’s 2017 accelerator program, also has invested in esports coaching platform Gamer Sensei and local tournament organizer Super League Gaming. AXiomatic didn’t disclose the size of Jordan’s investment, nor the other investors in the round.

Though esports remains tiny compared with traditional sports leagues, it’s expected to generate about $906 million this year, according to research firm Newzoo. Team Liquid got an early foothold in the industry nearly two decades ago in South Korea, where the popularity of StarCraft contests turned video gamers into well-paid celebrities. In more recent years, competitions have spread to the U.S. and beyond, packing audiences into venues like Madison Square Garden.

AXiomatic is co-chaired by Ted Leonsis, owner of the National Basketball Association’s Washington Wizards and National Hockey League’s Washington Capitals; Peter Guber, part owner of the Los Angeles Dodgers, Golden State Warriors and Los Angeles Football Club; Jeff Vinik, owner of the NHL’s Tampa Bay Lightning; and Bruce Karsh, co-founder of Oaktree Capital and a Warriors minority owner. Earvin “Magic” Johnson, another NBA Hall of Famer and minority owner of the Los Angeles Dodgers, also is an investor.

Jordan, who retired for the final time in 2003, has been active since he stopped playing. He became a minority investor in the Hornets — then the Bobcats — in 2006 and bought the rest of the franchise in 2010. In addition to his work with Nike Inc., he’s an investor in global sports data firm Sportradar, alongside Leonsis. He also has backed the hiring startup Gigster and headphone maker Muzik.

Continue Reading

-

Banking & Finance2 months ago

Banking & Finance2 months agoOman Oil Marketing Company Concludes Its Annual Health, Safety, Environment, and Quality Week, Reaffirming People and Safety as a Top Priority

-

News2 months ago

News2 months agoJamal Ahmed Al Harthy Honoured as ‘Pioneer in Youth Empowerment through Education and Sport’ at CSR Summit & Awards 2025

-

OER Magazines2 months ago

OER Magazines2 months agoOER, December 2025

-

News2 months ago

News2 months agoAI Security Conference 2025 Hosted by Securado Highlights the Changing Cybersecurity Landscape

-

Insurance1 month ago

Insurance1 month agoSupporting Community Wellness: Liva Insurance Sponsors Muscat Marathon 2026 with Free Health Checkups

-

Interviews1 month ago

Interviews1 month agoEXCLUSIVE INTERVIEW: TLS Rebranding Marks Strategic Leap Toward Innovation, Sustainability & Growth

-

Insurance4 weeks ago

Insurance4 weeks agoLiva Insurance Supports Community Wellness Through “Experience Oman – Muscat Marathon 2026”

-

Banking & Finance4 weeks ago

Banking & Finance4 weeks agoA New Platform for SME Growth: Oman Arab Bank Unveils Tumouhi

You must be logged in to post a comment Login