Investment

China Investor Buys Dirt Cheap Bank Stocks Nobody Else Wants

(Bloomberg) — To most investors, buying shares of Chinese banks seems like a losing strategy this year.

Under pressure from the government to sacrifice profits, stung by ultra-low interest rates and parrying the threat of souring loans, China’s biggest listed lenders have seen their shares sink 13% in 2020. They trade at a measly 0.7 times the projected value of their assets, near the lowest multiple since before the global financial crisis.

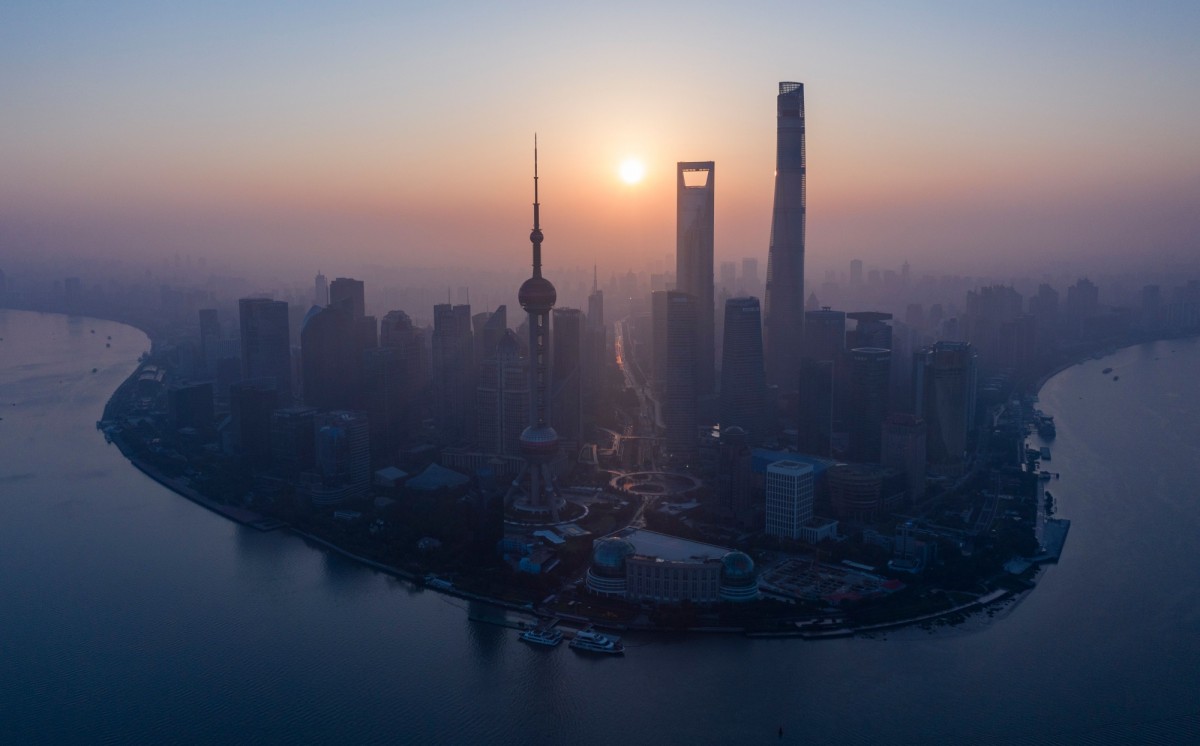

But for one Shanghai-based fund manager, the value case for Chinese bank shares is now so compelling that the stocks comprise one of the biggest parts of his portfolio. Zhou Liang, founder and fund manager at Shanghai Minority Asset Management Co., says prices already reflect a worst-case scenario for deteriorating profits and non-performing loans.

“The market has priced in too much pessimism,” said Zhou, whose firm oversees about 10 billion yuan ($1.4 billion). His flagship fund has outperformed the CSI 300 Index by more than 150 percentage points in the past five years, according to financial data provider East Money Information Co. “We believe many people misunderstand the banking sector.”

Zhou says concerns over asset quality, non-performing loans, profit sustainability and the impact of the pandemic have been overdone. “The four major banks and large joint-stock banks have no problems in terms of asset quality, as there are few toxic assets,” said Zhou via phone from his office in Shanghai. “The return on equity is relatively high, while operating costs of Chinese banks are low compared with those in the U.S. due to cheaper labor and rental.”

China’s loan prime rate — an indicator of the price that lenders charge corporates and households for loans — was unchanged in June, according to a statement from the central bank Monday. The de facto benchmark, which is decided by a group of 18 banks, has been steadily declining since it was introduced in August last year.

China is leaning on its massive banks like never before to help bolster an economy facing its worst slump in four decades. The government is asking them to keep profit growth below 10% while pushing the financial industry to sacrifice 1.5 trillion yuan in profit this year by offering lower lending rates, cutting fees, deferring loan repayments and granting more unsecured loans to small businesses. Zhou says that such policy headwinds are well priced in.

“In the past few years, the policy environment of banks and real estate has not been very friendly, but this does not prevent you from finding out how to profit,” said Zhou.

China’s financial stocks are trading at their cheapest level versus the MSCI China Index in more than a decade. So far this year they are the second-worst performer on the country’s benchmark CSI 300 Index.

Zhou’s flagship fund has made an accumulated return of more than 340% since inception in 2013. Since 2016 he has been all-in on mainland-listed blue chip stocks including banks, property developers, baijiu makers, insurers and some leading manufacturers. The fund has lost 5.7% in net asset value in 2020.

But Zhou is sticking to his conviction that a three-to-five year time frame will yield results. “The potential returns from banking stocks are far greater than the potential risks,” said Zhou.

-

Insurance2 months ago

Insurance2 months agoSupporting Community Wellness: Liva Insurance Sponsors Muscat Marathon 2026 with Free Health Checkups

-

Dossier2 weeks ago

Dossier2 weeks agoDossier, 2026

-

Interviews2 months ago

Interviews2 months agoEXCLUSIVE INTERVIEW: TLS Rebranding Marks Strategic Leap Toward Innovation, Sustainability & Growth

-

Insurance1 month ago

Insurance1 month agoLiva Insurance Supports Community Wellness Through “Experience Oman – Muscat Marathon 2026”

-

OER Magazines1 month ago

OER Magazines1 month agoOER, January 26

-

Banking & Finance2 weeks ago

Banking & Finance2 weeks agoNational Finance Unveils Exclusive Ramadan Offers on Auto Financing

-

Alamaliktistaad Magazines2 months ago

Alamaliktistaad Magazines2 months agoAl-iktisaad, January 26

-

Banking & Finance2 weeks ago

Banking & Finance2 weeks agoSohar International and Sohar Islamic Supports Over 100 Families in Al Wusta Governorate Through Its ‘Sohar Al Attaa’ Initiative