Economy

Nobody Knows How Dubai’s Economy’s Been Doing Lately

In Dubai, the focus is often too much on the economy of tomorrow rather than that of the recent past.

Even as it constructs the Museum of the Future ahead of an opening next year, the Middle East’s financial hub still hasn’t reported how its gross domestic product performed since 2017. Also missing are other figures considered basic elsewhere, ranging from retail and auto sales to industrial production.

The lack of an accurate read on the $106 billion economy leaves investors and businesses already stung last year by the world’s worst equity performance struggling to decide if it’s time to start buying. The official vacuum often forces them to glean insights from anecdotal conversations with retailers, owners of car dealerships and business conglomerates.

“We don’t really get a current view of what’s going on right now, there’s a very significant lag between the data and the economy,” said Tarek Fadlallah, chief executive officer of the Middle East unit of Nomura Asset Management. “If companies and investors don’t have conviction that the economy or a sector that they’re investing in has a brighter outlook, then it’s very difficult to make those decisions.”

The reasons for the dearth of data aren’t clear. No one at the emirate’s statistics center and its media office responded to requests for comment.

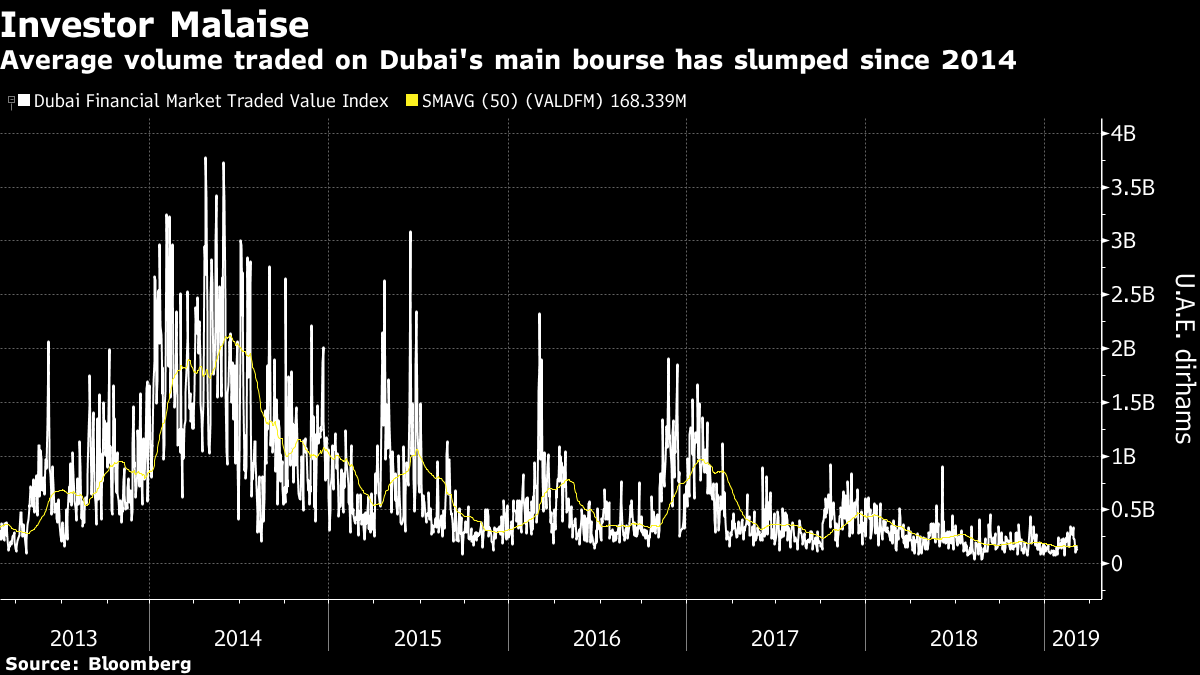

The market is in the dark at a time when trading volumes in local equities have plunged following the collapse of oil prices, putting plans for initial offerings on hold. Dubai, one of seven of the United Arab Emirates, has suffered faster stock declines last year than its peers in developing nations despite recouping losses in 2019.

“Investors dislike uncertainty, which can often be addressed with more transparency,” said Thea Jamison, a portfolio manager at Change Global Investment in Camas, Washington. “If the goal is to be a financial center, the U.A.E. should do better on the data front.”

The DFM General Index last year had its biggest drop in a decade as a property glut and faltering demand for real estate fueled share losses among developers. The 50-day daily average value of equities exchanged in Dubai’s main stock index has fallen about 92 percent from a peak in 2014, when MSCI Inc. officially included the U.A.E. in the emerging-markets category.

Although Dubai published quarterly GDP data as recently as mid-2018, the page for national accounts on the website of its statistics center now only lists full-year readings up to 2017. Some of the figures it provides, including foreign direct investment and construction activity, also haven’t been updated for two years.

Data Quality

The reliability of GDP data in the U.A.E. is rated below that of major emerging economies including South Africa and India and has a poorer grade than such Middle Eastern countries as Bahrain, Lebanon and Saudi Arabia, according to London-based research firm World Economics, which ranked 154 countries in its Data Quality Index published last September.

The reliance on anecdotal evidence in Dubai means the market is more susceptible to gossip and distortions as information is passed down through “Chinese whispers,” according to Fadlallah.

Emirates NBD, Dubai’s biggest lender, uses purchasing managers’ surveys as a snapshot of business conditions, said Khatija Haque, its head of Middle East and North Africa research. A report on the U.A.E. last November by HSBC Global Research featured a single page of text followed by 24 charts focusing on measures as varied as metro usage and employment in banking.

Arqaam Capital’s Abdul Kadir Hussain also casts his net widely. Hussain, who’s in charge of fixed income at the Dubai-based investment bank, said he relies on figures that range from banking liquidity data and portfolio quality to real-estate information from Dubai Land Department and brokers such as Jones Lang LaSalle.

-

Banking & Finance2 months ago

Banking & Finance2 months agoOman Oil Marketing Company Concludes Its Annual Health, Safety, Environment, and Quality Week, Reaffirming People and Safety as a Top Priority

-

News2 months ago

News2 months agoJamal Ahmed Al Harthy Honoured as ‘Pioneer in Youth Empowerment through Education and Sport’ at CSR Summit & Awards 2025

-

OER Magazines2 months ago

OER Magazines2 months agoOER, December 2025

-

News2 months ago

News2 months agoAI Security Conference 2025 Hosted by Securado Highlights the Changing Cybersecurity Landscape

-

Insurance1 month ago

Insurance1 month agoSupporting Community Wellness: Liva Insurance Sponsors Muscat Marathon 2026 with Free Health Checkups

-

Interviews1 month ago

Interviews1 month agoEXCLUSIVE INTERVIEW: TLS Rebranding Marks Strategic Leap Toward Innovation, Sustainability & Growth

-

Insurance4 weeks ago

Insurance4 weeks agoLiva Insurance Supports Community Wellness Through “Experience Oman – Muscat Marathon 2026”

-

Investment2 weeks ago

Investment2 weeks agoLalan Inaugurates Its First Overseas Manufacturing Facility, Marking Sri Lanka’s First Investment in SOHAR Freezone

You must be logged in to post a comment Login