Economy

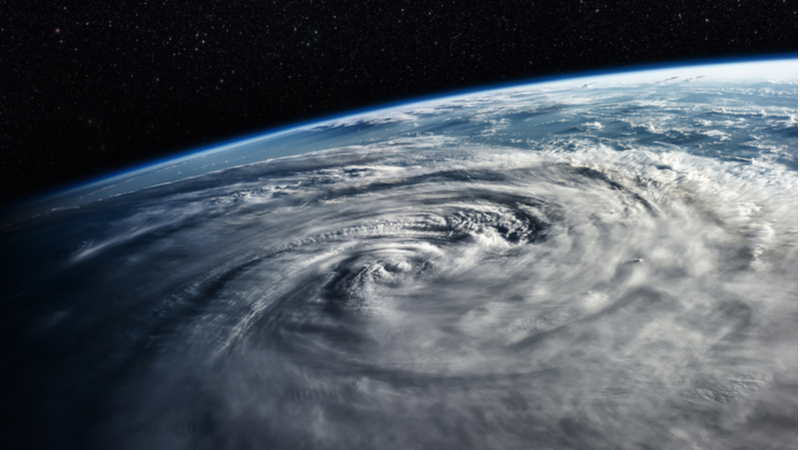

How Much Did Cyclone Shaheen Cost Insurance Companies In Oman?

The weekly reports monitored by the Capital Market Authority (CMA) to follow up on the insurance companies on settling the claims and paying the compensations after the cyclone ‘Shaheen’ revealed that the volume of the claims stood at about RO62.373mn so far.

This comes through the registration of more than 9,800 claims distributed over a number of the Wilayats affected by the cyclone in the governorates of Muscat, North and South Al Batinah.

The data indicated that most of the claims submitted to insurance companies were accepted for all those affected by the cyclone ‘Shaheen’ who hold insurance policies that cover the risks of natural disasters, whether to insure vehicles, property, transportation and other insurance coverages.

The data also indicated that about RO51.7mn are still under settlement as reparation for these damages requires some time because they are houses, buildings, and other facilities.

Insurance companies paid about RO10.6mn to redress other damages, and the indicators of the size of the compensation are expected to rise and reach approximately RO69mn by the end of the settlement of all claims related to the cyclone ‘Shaheen’.

As for the size of compensation for each insurance product, the data indicated that property insurance acquired the largest share, as its total compensation exceeded RO45.3mn, which represents insurance of homes, buildings, facilities, and other properties, followed by motor insurance with a total amount of RO8.9mn.

Then comes the engineering insurance with a share of about RO7.5mn, which is the insurance that is concerned with securing industrial sites, facilities, devices, and equipment. The rest is distributed to other types of insurance.

On the other hand, the data of the geographical distribution of insurance claims as a result of the cyclone ‘Shaheen’ showed the direct effects in a number of Wilayats of the governorates of North and South Al Batinah, as well as in the rest of the Wilayats of the Sultanate in a cumulative way to determine the affected spatial dimension and its concentration in the Wilayats and governorates.

The largest number of claims of all kinds was reported in the Governorate of Muscat, with 4,391 claims, followed by the Governorate of North Al Batinah, especially the Wilayat of A’Suwaiq, with a total of 2,632 claims, and the Wilayat of Al Khabourah, with 1,023 claims, while the rest of the claims were distributed among Wilayats such as Sohar, Saham, A’Rustaq, Al Musanah, and Barka.

The total volume of claims paid by insurance companies from the beginning of 2021 until 16 December 2021 amounted to about RO173.514 million. These figures reflect the role played by the insurance sector in managing risks at the level of individuals and institutions as one of the available means to enhance the principle of protection and social and economic security.

-

Banking & Finance2 months ago

Banking & Finance2 months agoOman Oil Marketing Company Concludes Its Annual Health, Safety, Environment, and Quality Week, Reaffirming People and Safety as a Top Priority

-

News2 months ago

News2 months agoJamal Ahmed Al Harthy Honoured as ‘Pioneer in Youth Empowerment through Education and Sport’ at CSR Summit & Awards 2025

-

OER Magazines2 months ago

OER Magazines2 months agoOER, December 2025

-

News2 months ago

News2 months agoAI Security Conference 2025 Hosted by Securado Highlights the Changing Cybersecurity Landscape

-

Insurance1 month ago

Insurance1 month agoSupporting Community Wellness: Liva Insurance Sponsors Muscat Marathon 2026 with Free Health Checkups

-

Interviews1 month ago

Interviews1 month agoEXCLUSIVE INTERVIEW: TLS Rebranding Marks Strategic Leap Toward Innovation, Sustainability & Growth

-

Insurance3 weeks ago

Insurance3 weeks agoLiva Insurance Supports Community Wellness Through “Experience Oman – Muscat Marathon 2026”

-

Banking & Finance4 weeks ago

Banking & Finance4 weeks agoA New Platform for SME Growth: Oman Arab Bank Unveils Tumouhi