Banking & Finance

Qatar Helps StanChart Dethrone HSBC as Gulf’s Top Bond Manager

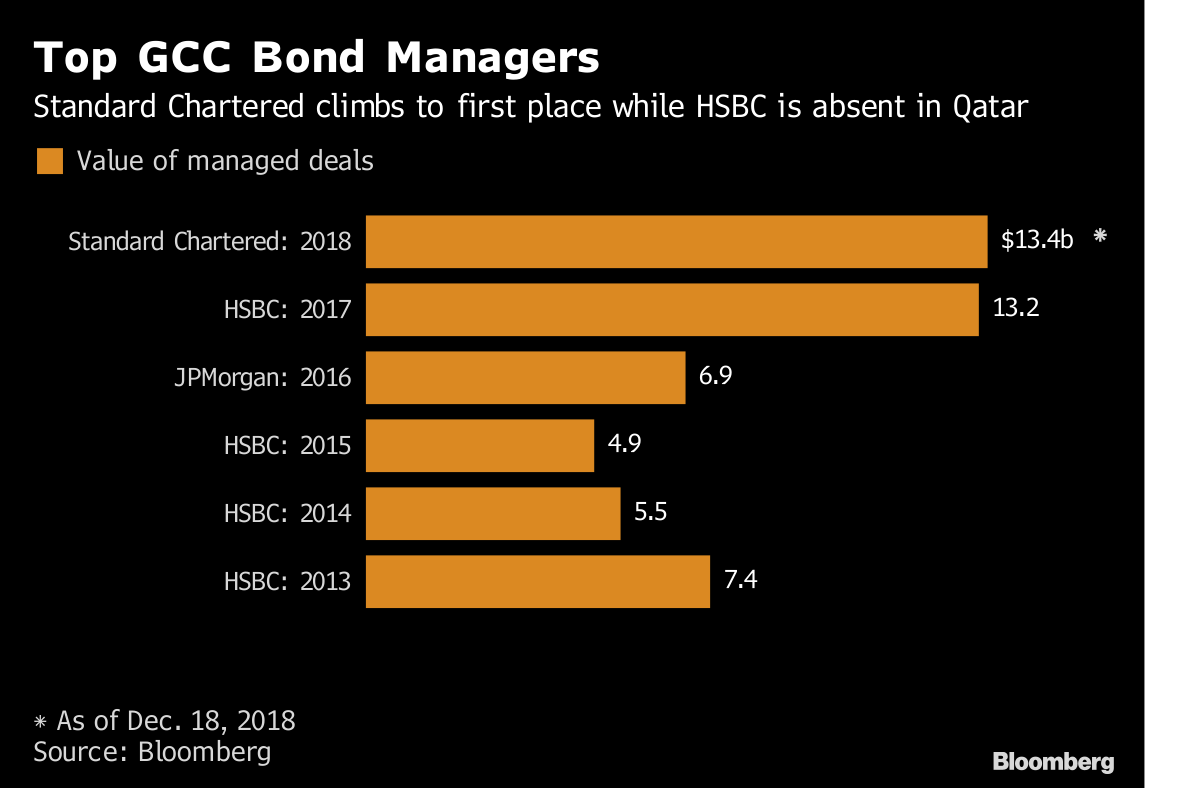

Standard Chartered Plc replaced HSBC Holdings Plc as the top manager for bonds and sukuk in the Gulf region this year.

HSBC lost out after not doing a single deal in Qatar since June 2017, when Saudi Arabia and other Gulf Cooperation Council states imposed a diplomatic embargo on their neighbor. Fellow British lender Standard Chartered continued to manage bonds in both countries — leapfrogging its rival in the process.

Many institutions “may have decided that, until there’s a diplomatic breakthrough, they should limit themselves to bidding for the business of only one of the sides,” said Richard Segal, senior analyst at Manulife Asset Management in London.

HSBC declined to comment, while a Standard Chartered representative couldn’t be reached.

The total value of GCC bond deals so far this year reached $77.4 billion, data compiled by Bloomberg show. Standard Chartered accounted for 17 percent of this, with second-placed HSBC on 10 percent.

While HSBC didn’t have any contracts in Qatar in 2018, Standard Chartered raised money for both countries. It did deals for Saudi Basic Industries Corp. and Saudi Electricity Co. — majority owned by the Saudi Public Investment Fund — as well as for the Qatari government.

“Banks need to decide where their focus will lie,” said Doug Bitcon, a fund manager with Rasmala Investment Bank in Dubai. For some banks, “if your focus is Saudi, it is likely that you are doing less business in Qatar, and vice versa.”

-

Banking & Finance2 months ago

Banking & Finance2 months agoOman Oil Marketing Company Concludes Its Annual Health, Safety, Environment, and Quality Week, Reaffirming People and Safety as a Top Priority

-

News2 months ago

News2 months agoJamal Ahmed Al Harthy Honoured as ‘Pioneer in Youth Empowerment through Education and Sport’ at CSR Summit & Awards 2025

-

OER Magazines2 months ago

OER Magazines2 months agoOER, December 2025

-

News2 months ago

News2 months agoAI Security Conference 2025 Hosted by Securado Highlights the Changing Cybersecurity Landscape

-

Insurance1 month ago

Insurance1 month agoSupporting Community Wellness: Liva Insurance Sponsors Muscat Marathon 2026 with Free Health Checkups

-

Interviews1 month ago

Interviews1 month agoEXCLUSIVE INTERVIEW: TLS Rebranding Marks Strategic Leap Toward Innovation, Sustainability & Growth

-

Insurance1 month ago

Insurance1 month agoLiva Insurance Supports Community Wellness Through “Experience Oman – Muscat Marathon 2026”

-

Investment2 weeks ago

Investment2 weeks agoLalan Inaugurates Its First Overseas Manufacturing Facility, Marking Sri Lanka’s First Investment in SOHAR Freezone

You must be logged in to post a comment Login