PR

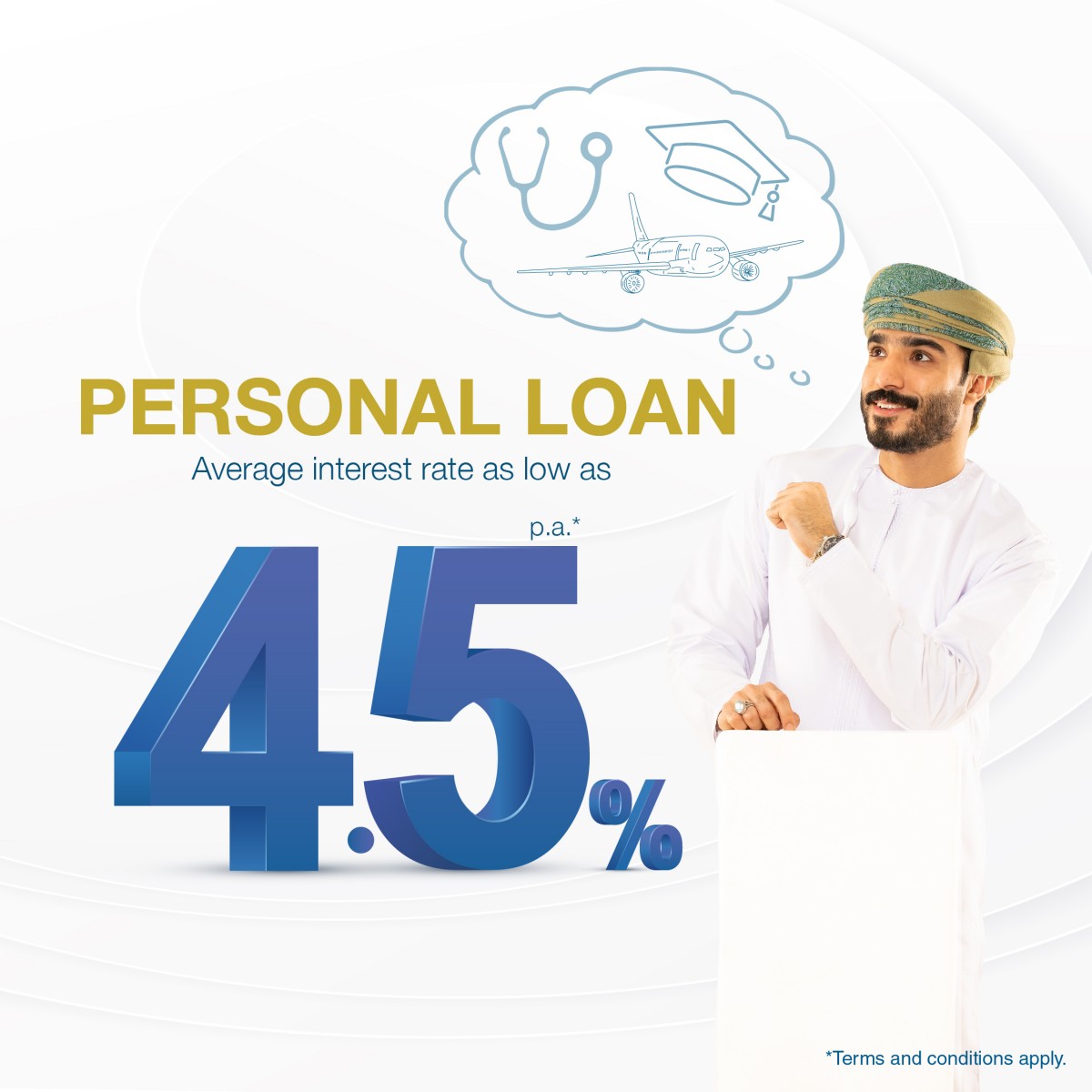

Ahlibank Offers Personal Loans With Interest Rates Starting From 4.5%

In a bid to enhance financial freedom and establish accessible avenues to fulfill personal obligations and aspirations, ahlibank is offering a bouquet of loans through its popular MyLoan facility, at interest rates starting from 4.5%.

The personal loan program is structured to facilitate customers with right credit options that entail competitive pricing and flexible repayment terms with hassle free experience. It is aligned with best industry practices to ensure quicker turnaround time for loan approvals, offering customers the choice to opt for tenures and plans that are suitable for their salaries/incomes.

The loan program is open to customers from all walks of life, with the Bank setting slabs for government and private sector employees, as well as for expatriates. The maximum loan amount is accordingly fixed, with OMR 200,000 for Omani employees in the government and quasi government sectors, and OMR 150,000 for Omanis employed in the private sector. Expatriates can avail a maximum of OMR 50,000 as personal loans.

While the maximum age of maturity or retirement is 60 years for Omanis and 55 years for expatriates, the maximum loan tenor is up to 10 years for Omanis and up to 5 years for expatriates. All customers need to complete a mandatory requirement of six months of service and should be aged not less than 21 years.

“ahlibank’s MyLoan is the key to unlock doors to our customers’ dreams and aspirations; we want to instill in them a sense of financial freedom to be able to meet the priorities in their lives. We have, since the beginning, endorsed the idea of financial inclusion and have created exciting avenues and promotions to build customer confidence. This has borne results; today, we see customers approaching us through our branches to seek financial solutions for their everyday requirements, as well as for major purchase decisions,” explained Muneer Al Balushi, AGM – Head of retail distribution at ahlibank.

Adding further, he said, “The very idea behind MyLoans is to motivate customers to start realizing their dreams. Our prime objective is to apprise borrowers that there are no additional burdens and that the repayment option is relatively smooth and convenient.”

ahlibank’s personal loan program is suitable for customers of different banking segments, as it is in sync with the Bank’s customer-centric operations.

-

Banking & Finance3 weeks ago

Banking & Finance3 weeks agoOman Oil Marketing Company Concludes Its Annual Health, Safety, Environment, and Quality Week, Reaffirming People and Safety as a Top Priority

-

Economy2 months ago

Economy2 months agoMaal Card: What Oman’s New National Payment Card Means for Everyday Users

-

News2 months ago

News2 months agoSheikh Suhail Bahwan, Chairman of Suhail Bahwan Group, Passes Away

-

News2 months ago

News2 months agoOIG Appoints New CEO to Lead Its Next Chapter of Excellence

-

News1 month ago

News1 month agoReport: How India & The Middle East Are Exploiting Immense Economic Synergies

-

Economy2 months ago

Economy2 months agoOman Unveils Official Omani Rial Symbol in Landmark Move to Boost Global Currency Presence

-

Uncategorized1 month ago

Uncategorized1 month agoOman’s ISWK Cambridge Learners Achieve ‘Top in the World’ and National Honours in June 2025 Cambridge Series

-

Trade2 months ago

Trade2 months agoConsulate Office of the Republic of South Africa opens in Muscat, enhancing bilateral relations