International

A.T. Kearney expects debt-driven oil and gas shakeout

Depressed oil prices will force oil and gas companies in distress to seek scarce buyers in a debt-driven shakeout, according to A.T. Kearney’s Oil and Gas M&A Outlook. The report, which was released recently reveals that 2016 will be a pivotal year for all oil and gas companies as they look to complement their aggressive capex and cost reductions with divestitures, mergers, and acquisitions.

Globally, companies with weak balance sheets will be forced to offload assets and seek partners to support their cash position as funding options dry up, while companies in a stronger financial position will have the opportunity to capture reserve and merger synergies.

“There will be ample opportunities for potential buyers, and we expect to see a surge in assets and companies up for sale,” said Richard Forrest, A.T. Kearney’s global lead partner for the Energy Practice and co-author of the report.

“Despite the drop in oil prices since mid-2014, the low-cost Gulf producers remain largely profitable. However, continued fiscal pressure will push many countries and their national oil companies to focus on internal operational efficiency and economic diversification rather than large-scale international M&A. With the increased focus on value and job creation as well as diversification, new partnership opportunities will arise for international players,” said Ada Perniceni, partner, A.T. Kearney.

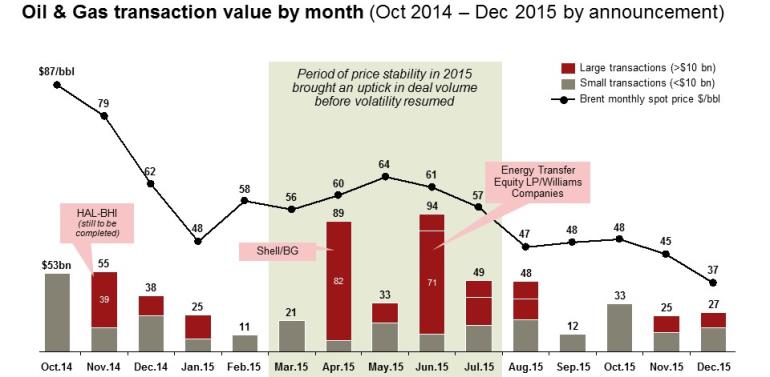

In 2015, oil and gas M&A activity was limited with only a few major deals dominating headlines such as Royal Dutch Shell’s $81.5 billion acquisition of BG Group. Midstream deal value rose by 68 per cent, with the Energy Transfer Equity–Williams deal in the lead. Master limited partnerships (MLPs) largely contributed to this increase, making up well over half the total deal value.

However, total upstream deal value declined by 13 per cent; if the impact of the outsized $81.5 billion Shell–BG deal in 2015 is excluded, total upstream deal volumes dropped by 54 per cent. Oil field services total deal volume declined 61 per cent, and with the exception of the Cameron International–Schlumberger transaction, the top 10 deals involved financial investors rather than incumbent firms within the industry purchasing oil and gas assets.

Recent price volatility has created sharp differences in valuation expectations between buyers and sellers, delaying M&A decisions. Companies are focusing on cash preservation and cost reductions but are quickly exhausting options and now have to dig deeper and structurally change their strategies.

This year will be a pivotal one as cash and liquidity concerns drive a shakeout for those with high costs and debt, the report said. Operators with high debt holdings, especially those relying on reserve-based lending, could see their funding squeezed and credit facilities reduced, triggering them to shed low-performing assets.

This will present opportunities for those willing and able to adopt contrarian strategies and take advantage of creative deal structures. M&A deals—whether acquiring, partnering, or divesting—will be a vital way to grow value, cut costs, and navigate the new, more turbulent landscape.

“There are limited buyers today, but the current situation represents a huge opportunity for those with the financial strength required,” said Alvin See, A.T. Kearney principal and co-author of the report.

“Companies, including selected national oil companies (NOCs), may capitalize on the current climate to secure reserves or expand operations, and financial investors are busily gearing themselves up for deals. Any run-up in oil prices lasting a couple of quarters will likely be met with a flurry of deals.”

Stronger independents will have the opportunity to acquire assets at a deep discount as debt covenants and redeterminations will play a larger role in triggering M&A. Financial investors will also seek opportunities to put capital to work, targeting different levels of return through varied M&A approaches.

International oil companies (IOCs) will focus on structural cost reduction and portfolio high-grading, making selective acquisitions and continuing divestment programs, especially in unconventional resources, more likely than mega-mergers. BP, Chevron, and Shell, for example, have announced over $45 billion in combined asset sales over the next few years.

The report forecasts that geopolitics will have a major impact on M&A activity as fiscal austerity will limit M&A in the Middle East, while in China opportunistic oil and gas M&A will play well into Xi Jinping’s “One Belt, One Road” vision. In addition, 2016 will bring consolidation as smaller companies become targets or start to consider creative financing options.

“The year ahead will require tough decisions and a survival mind-set for many non-competitive operators,” Richard Forrest concluded. “For those willing to think and strategize creatively, 2016 will be transformational for individual companies and the long-term future of the industry.”

-

Banking & Finance1 month ago

Banking & Finance1 month agoOman Oil Marketing Company Concludes Its Annual Health, Safety, Environment, and Quality Week, Reaffirming People and Safety as a Top Priority

-

News1 month ago

News1 month agoJamal Ahmed Al Harthy Honoured as ‘Pioneer in Youth Empowerment through Education and Sport’ at CSR Summit & Awards 2025

-

Economy2 months ago

Economy2 months agoPrime Minister of India Narendra Modi to Visit the Sultanate of Oman on 17-18 December

-

Economy2 months ago

Economy2 months agoOman’s Net Wealth Reaches $300 Billion in 2024, Poised for Steady Growth

-

News2 months ago

News2 months agoIHE Launches Eicher Pro League of Trucks & Buses in Oman

-

News2 months ago

News2 months agoLiva Insurance Honored with ‘Insurer of the Year’ Award for 2025

-

OER Magazines1 month ago

OER Magazines1 month agoOER, December 2025

-

News1 month ago

News1 month agoAI Security Conference 2025 Hosted by Securado Highlights the Changing Cybersecurity Landscape

You must be logged in to post a comment Login