(Bloomberg) –The retail tranche of Saudi Aramco’s initial public offering is fully covered with one day to go. Subscription reached 32.6 billion riyals ($8.7 billion) with...

(Bloomberg) –Abu Dhabi is planning to put as much as $1.5 billion into Saudi Aramco’s initial public offering, as the oil giant taps friendly neighbors to...

(Bloomberg) –Saudi Aramco will meet investors in Abu Dhabi on Monday to drum up support for its share sale after pitching the offering in Dubai. Chief...

(Bloomberg) –Saudi Arabia’s main equity index fell the most in the Gulf on Sunday ahead of Saudi Aramco’s giant listing. The Tadawul All Shares Index finished...

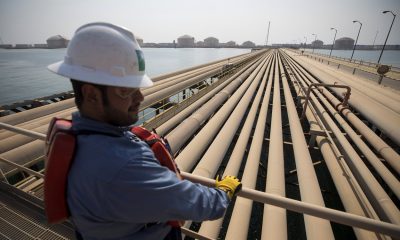

(Bloomberg) –Climate change poses a serious risk to Saudi Aramco’s long-term business as rising sea levels and temperatures could damage infrastructure, curb productivity and even halt...

(Bloomberg) –Saudi Aramco’s bankers are seeing sufficient early demand to pull off the state oil giant’s initial public offering just three days after launching the deal,...

(Bloomberg) –Saudi Arabia set a valuation target for Aramco’s initial public offering well below Crown Prince Mohammed bin Salman’s goal of $2 trillion and pared back...

(Bloomberg) –Saudi Arabia put a valuation on state-owned oil giant Aramco of between $1.6 trillion and $1.71 trillion, well below the $2 trillion target sought by...

(Bloomberg) –Saudi stocks opened higher as investors digested the kingdom’s plan to sell a 1.5% stake in the state-owned oil producer. Al Rajhi Bank and National...

(Bloomberg) –Morgan Stanley is one of the most bearish — and bullish — on Saudi Aramco’s valuation. In a presentation for investors, Morgan Stanley bankers ran...